- IRAS Announcement

From 1 Aug 2016, the following changes to PIC Cash Payout Scheme will take effect:

1. Reduction of cash payout rate for qualifying expenditure incurred on or after 1 Aug 2016 from 60% to 40% (the cash payout rate is not determined by the date of submission of the cash payout application); and

2. Compulsory e-Filing of cash payout applications. Hardcopy applications will not be accepted from 1 Aug 2016.

Under the scheme, businesses can enjoy

a. 400% tax deductions / allowances or

b. 40% cash payout for investments

- What is PIC ?

PIC stand for Productivity & Innovation Credit scheme. It was introduced in Budget 2010 for Year of Assessment (“YA”) 2011 to YA 2015 to encourage productivity and innovation activities in Singapore. As announced in Budget 2014, the scheme is extended for three years till YA 2018.

|

|

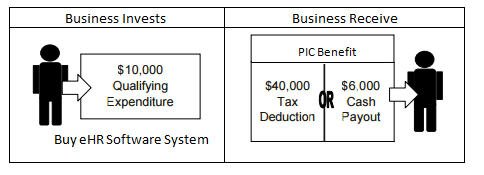

Businesses will be able to tap on to the PIC Scheme to implement eHR Software System.The diagram below illustrates the benefits available to a business when it invests eHR Software System for productivity or innovation activities.  |

Tax Deductions/ Allowances Cash Payout

|

Source: IRAS Productivity & Innovation Credit scheme

https://www.iras.gov.sg/irashome/Schemes/Businesses/Productivity-and-Innovation-Credit-Scheme/